Your second role in financial governance (education finance) is to review and approve the financial statements of the School Board.

- Your year-end financial statements are audited, approved by the board and then provided to the Ministry and public as part of your accountability responsibilities.

- You should also review interim financial reports, at least quarterly. These are usually not audited, and might not be used outside the School Board itself.

Your purpose in reviewing financial statements and reports is to gain reasonable confidence (assurance) that these are fair, accurate and reliable (have “integrity”.)

The good news is that you do this by reviewing the work of others, rather than doing the work yourself. Just as with other roles in governance, your role is to oversee, to ask questions, to gain confidence. And you don’t need to be an accountant to do this well!

Here is who is responsible for what in financial reporting:

- Management (the Director of Education and CFO) is responsible for preparing the financial statements and reports, including:

- Accounting methods, choices, estimates, judgements and assumptions underlying these, and

- Selecting accounting, financial and other controls and making sure they are effective.

- If you have internal auditors (may be staff and/or outsourced), they are responsible to conduct risk-based testing of controls to report to you (the board and management) on their effectiveness. This begins with internal controls over financial reporting (“ICFR”), and extends to all material controls in the School Board. If you don’t have an internal auditor, you should discuss whether and how the external auditors and staff will cover off the most important parts of this work.

- Other independent professionals: your School Board may use actuaries, compensation advisors, legal counsel, SSBA experts, governance consultants, facilities and environmental assessors and others. Each of these reports to the board and management on areas of their expertise, and most of these will have implications for the financial reports.

- The Audit & Finance Committee: your board probably uses a standing sub-committee that is responsible to review the financial statements and reports before they come to the board, to review these with management, auditors and others, then recommend them to the board.

- The board: at the full board level, you conduct a high level overview of the financial statements and reports.

- Your external auditors (sometimes called the “appointed” auditors, since you appoint them) are responsible to conduct a materiality-based audit (testing) of management’s prepared financial statements, in order to provide an opinion as to whether they are fair, prepared according to accepted accounting principles/standards. It is important to understand that this opinion is granted when the External Auditor has gained “reasonable assurance” not “absolute assurance” that that the financial statements are free from material misstatements and done according to accepted accounting principles/standards. This is a licensed independent professional accountant or firm, who may be locally based, regional, national or global.

- The Office of the Provincial Auditor is responsible to the Legislature to provide independent assurance and advice on the management, governance, and effective use of public resources. Wherever public funds are used, the Provincial Auditor may conduct audits, or it may review and rely on the work of your appointed auditor.

At a board level, then, your steps here are to:

- Be confident that management and auditors are competent, diligent and independent (from each other):

- when you first recruit/appoint them,

- at the beginning of each year by reviewing their mandates and workplans, and

- at the end of each year by evaluating their effectiveness.

- Read their reports diligently: this is the most important part of preparing for board and committee meetings, for fulfilling your legal duty of reasonable care.

- At meetings, ask them questions about their reports: prepare a few questions ahead of time, then listen and be ready to follow-up another board member’s question if it hasn’t been clearly answered. Some questions for you to consider:

- Where do you see our most significant fraud risk residing in our operations and how has the audit addressed these issues

- Have all the taxes or statutory withholdings been made appropriately?

- As you read their reports and listen to their answers, are you hearing resonance among all of them (CFO, Director, external auditor, internal auditor, Provincial Auditor, SSBA, other independent professionals)? If so, you are entitled to rely on their collective work. But, if you are hearing dissonance, substantial differences among their reports and responses, then your job isn’t done. You need to ask more questions, and potentially you may need to send them back to work out any outstanding unresolved issues. Or you may need to resolve them yourself at the board level, if you are running out of time.

As with other steps in governance, this is an art – you will want to focus on important issues and risks (“material”), and not spend too much time on issues or risks that don’t matter to any of the users of the financial statements (the board, the Ministry, lenders and other funders, the community and public).

Financial Statements

This Handbook is not intended to be a substitute for education financial literacy or training, which you are encouraged to study on a continual basis during your service as a school board member. However, here are some of the things to be looking for and asking about in the School Board’s financial statements:

This Handbook is not intended to be a substitute for education financial literacy or training, which you are encouraged to study on a continual basis during your service as a school board member. However, here are some of the things to be looking for and asking about in the School Board’s financial statements:

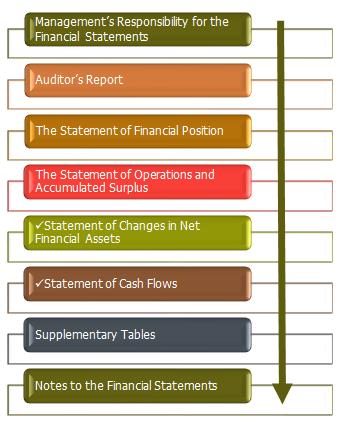

Your year-end audited financial statements begin with two pages:

- Management’s Responsibility for the Financial Statements: this outlines the different responsibilities of management, board and auditors, and is signed by the CFO, Director of Education and a Board Member, and

- Auditor’s Report: this outlines the auditor’s responsibility and work, and their audit opinion, and is signed and dated by your external auditor. You will want to ask if there were any exceptions or qualifications to the audit opinion, and any outstanding or unresolved issues, whether these are in the auditors’ management report or not. There should not be a significant gap between the audit date and your meeting date to approve these.

The primary financial statements are next:

- The Statement of Financial Position (formerly the “Balance Sheet”): shows

- Assets: what the School Board owns, you receive future economic value, and

- Liabilities: what the School Board owes, you deliver future economic value, and the difference between these: “Net Assets” or “Accumulated Surplus” (which is equivalent to owner’s equity in the private sector).

- Numbers are shown for this year-end and the previous year-end for comparison purposes.

- Assets and liabilities are shown in order of liquidity, that is, how quickly they will go through cash (in or out).

- Financial assets may be reported separately from non-financial assets.

- This is signed by two officers of the School Board, including at least one board member, to indicate that the financial statements have been approved by the board.

- The Statement of Operations and Accumulated Surplus (formerly the “Profit and Loss”) shows

- Revenues: you earned for delivering economic value this year, and

- Expenses: you incurred in order to deliver economic value this year, generally following the same line items and order as the budget and funding outlined earlier.

- Again, these include this year’s and last year’s numbers.

- Any operating surplus (revenues greater than expenses) is added to the Accumulated Surplus. If you have an operating deficit (expenses greater than revenues), this is subtracted (this is how the balance sheet balances).

Secondary financial statements follow – these are re-presentations or more detailed breakdowns of numbers in the primary financial statements to help you track and ask questions about changes from year to year:

- Statement of Changes in Net Financial Assets

- Statement of Cash Flows

- Supplementary tables of Revenues, Expenses, Tangible Capital Assets and Non-Cash items, in more detail than the primary financials.

Notes to the financial statements follow. These are probably the most informative parts of the financial statements, and where you will want to focus your time in preparing and asking questions of management and the auditors:

- Note 1 always deals with the entity – what is the legal basis and “business” of the organization (School Board)?

- Note 2 always deals with accounting policies, including the accounting standards used (there are at least 5 different sets of accounting standards in Canada today), accounting methods chosen, changes, implications and estimates. With today’s accounting standards, this is usually the longest note, and while it can get technical at times, you will want to:

- Exercise professional skepticism (like an auditor) but not cynicism (turning over rocks looking for something wrong).

- Ask management and the auditors if there are any issues they want to highlight, and any differences in opinion or approach (listening for resonance or dissonance)?

- Don’t be afraid to ask a “dumb question” – board members are not financial experts, that is why you hire and pay a CFO and auditors who are.

- Hold a brief in camera session with the auditors before they leave, but without management in the room – ask them about the conservatism or aggressiveness of management’s estimates and judgments, and about the audit tone itself. Is there anything else that you haven’t reported or written down? Final advice or tips? Do the same thing with your CFO, internal auditor and Provincial Auditor in turn, without the others in the room. Use this information with tact and professionalism.

- The next few notes explain line items from the primary financial statements, in the same order as they are presented – the note number is indicated next to each item on the primary financial statements. Follow the same approach as you did with Note 2. Because financial statements are prepared on an accrual basis, not a cash basis, several accounts appear that you will want to understand and may ask about:

- Prepaid expenses: cash has been paid out, but you haven’t received the economic value or benefit yet (e.g. insurance paid for a full year),

- Deferred revenues: these are the opposite – you’ve received cash, but haven’t delivered the economic value or benefit yet (e.g. property tax payments received but not used yet),

- Pension and benefits: these follow economic value accounting, that is, the discounted value of future projected cash flows in (assets) and out (liabilities). These involve more estimates than most other items in the financial statements. One is the “discount rate” which is the time value of money (cash today is worth more than cash a year from now). Another is the estimated life span of people covered in the plans. That is why an independent professional actuary is hired to review and report on these, usually every three years.

- The final notes deal with anything else that users of the financial statements should know, such as:

- Restrictions on the use of assets, surplus or reserves. These may be externally imposed restrictions (by the Ministry or a trust, for example), or they may be approved by you, the board (internally restricted). Reserves or restrictions are usually set up to provide for future needs that are several years out, like capital projects. You will want to have a good dialogue on, and understanding of, these. In fund accounting, these are called different “funds”.

- Related Parties: because School Boards are public sector entities, any Government of Saskatchewan entity is a “related party”. Your main focus here should be on related parties where your officers or employees have closer relationships, and where a transaction might not be at arms-length. Your auditor should be checking these for you.

- Off balance sheet items such as commitments, contingencies and subsequent events.